forex strategy | forex forecast | forex signal | forex signals | forex scalping | BCOUSD | Gold | XAUUSD | Brent Crude Oil | technical analysis | historical data

Sequence of Analysis

2. Support / Resistance

3. Price Actions

4. MACD / Stochastic

5. Overbought / oversold - two long candle (hourly / 4H / Daily

Saturday, October 5, 2024

Behind the Curtains: How Banks Outmaneuver Retail Traders in Forex Markets

Saturday, February 3, 2024

None of the Technical Indicator's strategy will work permanently as it is.

Friday, April 16, 2010

Ultimate Knowldge of Becoming Forex Trader - Improved!!

Today i am going to discuss about my experience, research (trial and errors), and knowledge that i have learn from many sources to provide guidelines for others to learn. I believe there are plenty of sources i.e. books, internet articles, forums, blogs, websites provide free lesson about forex trading but it will be useless if you fail to harvest the right information and put them into one working effective strategy.

Apart it will takes significant amount (probably years) of time to study and fully understand each of the knowledge. In the end you will have to combine to provide the best result for your trade. During your trial and errors you will make profits and losses, don't worry about the losses because that's what it takes to be real good by being able to keep up confidence run high at all time. If you worry too much about it, use demo account but be serious about it.

Over 4 years of learning and trading experiences i have strongly believe that below strategy will work very well if applied with wisdom, patience, and of course luck. Learn each of them and combine them into one working strategy, that will give you the edge for better understanding of the forex market.

- Moving Average Convergence/Divergence (MACD) - Very powerful lagging indicator built based on moving average. It is called "lagging" indicator because the signal always delay behind the real market movement. The strength of MACD is to provide the long-term signal of the market movement. And weakness of MACD is because it's delayed always behind the the market movement. Why MACD is important because everyone seems to use it and you must follow the crowd to be a winner.

- Stochastic - It is similar to MACD indicator but the signal is close to the real-time market movement. Very popular indicator for short-term traders or scalpers who look for quick trade in daily trading. Obvious weakness of the stochastic indicator is providing signal too early prior to the market movement. Most often it fails to indicate the overbought oversold movement. It is important when combine with MACD it provides better trading signal rather than use it alone.

- Bollinger Band - Build on 3 lines of moving average lines namely the upper band, middle band, lower band. The Bollinger Band provide signal for setup and profit targets. Point of support and resistant can be trace by the Bollinger Band line.

- Counting Candlestick - By counting the candlestick you will be able to see clearly the market movement (price action) and not getting tricked by the short-term fluctuation behavior. If you plan your trade by weekly basis you have 5 candlestick (from Monday to Friday) using the help of MACD and Stochastic indicators you can estimate how many candlestick will go up and how many will go down.

- Multiple Time Frames - It is very important to understand the perspective of multiple time frame because of the existence of short-term, intermediate-term, and long-term traders.

- Support and Resistant Level - Repeated chart patterns and behavior create a clear line of support and resistant point. It is very important to take note of this critical point because technical indicators often fail to cross the line and traders tend to follow the repetitive pattern instead.

- Non-Farm Payroll (Fundamental News Release) - During non-farm payroll release the market move according to the news and there are no indicators can predict market direction.

- Good Luck - It need a lot of good luck to succeed in forex trading. No matter how much knowledge you have but to apply real trading to yield consistent result is another matter. So plan your trade properly to get better luck.

Renew Antivirus Store

Monday, April 21, 2008

Trading History Ultimate Knowledge

In the larger institution like banks, hedge fund, and big trading company they are able to record all these in the form of statistical records using automated software. Therefore they have the advantage to study more detail picture of twist and turn in the market in the smallest time frames possible. And because of that they are better than individual traders. Unfortunately for us individual traders we have to build our own statistical record on manual basis where it requires time and efforts to do it. So in order to make our trading decision simple we just rely on indicators that we believe work effectively and ignore the recording part.

Why should we record indicators' behavior, chart patterns, and price history? It is to increase our understanding on of the effect on indicators on the overall market behavior and chart patterns as well as familiarizing ourselves on the unpredictable area of the market.

Indicators Behavior and Chart Patterns Formation

If you have studied the market as in-depth manner you should be able to identify that there is relationship of the technical indicators behavior and the chart patterns such as double tops/bottoms, head and shoulders, or hell's triangle. Especially MACD and Stochastic have so much impact on the chart patterns formation.

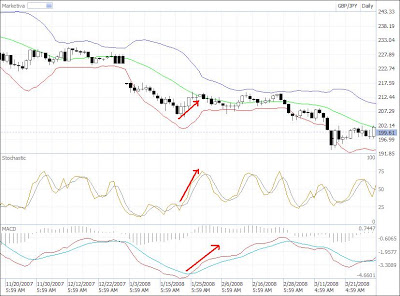

As discussed before that the stochastic move faster than MACD but unable to build a solid movement without the MACD indicator. Because of this reason stochastic alone moving in opposite direction of MACD only give you a temporary move in which eventually later it will return to the place where it started. As a result it will create a double tops/bottoms, head and shoulders, or hell's triangle. See the chart…

Notice that at major resistance level on the GBP-JPY downtrend when stochastic moving alone downwards the chart did not make continuation of the trend but instead return back to the same support level to form double tops (M shape). And then when both MACD and Stochastic moving downwards the trend start to continue moving to the next level of support and resistance. This is also apply to the to double bottoms (W shape) formation.

The concept of head and shoulders is very similar to the double tops/bottoms and the only difference is the middle movement higher creating a chart that look like a head and shoulders figure. This happens because the stochastic is unsuccessful to move alone downward and instead making the continuation even higher when the chart it is moving along the MACD line again. And after that stochastic test again the resistance level until it eventually when MACD starting to show downward direction. As both move down it will create strong movement downwards.

The hell's triangle can most bee seen during the non-farm payrolls data release because traders trying to make quick profits. The market usually go ups or downs in high volume but temporary and eventually return to the normal movement. Sometimes it happens also in normal movement where MACD movement relatively weak.

The chart patterns formation also associated to the price historical movement. When all indicators seems to fail to notice where exactly the price will stop moving just take a glance to look at the previous target where it has been reached. There you will find that it might stop somewhere within the same level of the previous target. That's where you will find the overall patterns will form double tops/bottoms, head and shoulders, or hell triangle.

The Number of Peaks/Troughs in resistance Area

Have you ever thought of making studying the number of peaks and troughs created in every major support and resistance level? If you have not yet done that let's take a look at how many of them within support and resistance area. See chart…

Notice that the repeatable patterns generally form the identical number of peaks and troughs at every resistance level. The importance of taking note the number of peaks and troughs is to provide the traders general idea how many times the market will fluctuate whenever the market rest at the major support and resistance level before any continuation or reversal takes place. This will give them precision counts and make sure the market move according to their decision.

Thursday, April 17, 2008

Price History Indicator

As the market keeps continue its movement this will create psychological stress which could possibly force them to close positions prematurely resulting in substantial losses. Then upon reaching its target limits the market suddenly reverse and so will regrets followed up ;). For those whose deposits are big enough to stand the pressure may be patience enough to wait to save themselves and gaining small profits. These mistakes are unavoidable if you have little experience about the various possibilities of the market actions.

How can experience traders still able to handle such an unpredictable situation even when all other technical indicators fail? The answer is simple and it is call price history. Just like people use to say history repeat itself, and this statement also hold true in the forex trading. Price movement usually targets a place where it has been reached previously. If you are a savvy trader who observe the chart closely you will notice that price will go up and down very identical to their previous reached target. See the chart below…

So next time when you are looking into all the failures of your indicators don't worry look for the previous target and hit the place your position around there you will see fast profits moving piled up within minutes.

If you need to read more about this read here "The Memory of Price Strategy" written by Kathy Lien and Boris Schlossberg from Investopedia.

Tuesday, April 15, 2008

MACD, Stochastic, Bollinger Band Combinations

Supposed that the initial Bollinger band position is at the bottom and both MACD and slow stochastic is about to move in the same parallel direction upwards. So the potential profit target is somewhere around the middle or higher of the daily the Bollinger band.

If the initial position of the B. band start from the middle and both MACD and slow stochastic is up the then end target should reside somewhere in the upper band or higher of the daily time frame.

This discussion only covered the single daily time frame without considering other higher time frame i.e. weekly and monthly. If multiple time frame involve there should be slightly different in target profit of setting because of the effects. However not to worry about that because based on the research that I've done for a year now a single time frame is somehow adequate enough for good analysis.

Try to practice this method on your chart for example using 4 hourly or hourly time frame see what you will get and tell me here in my blog if anything goes wrong.

Sunday, April 13, 2008

Reversal Indicators

Bollinger Bands

As I have discussed before the Bollinger bands will signal a reversal when the movement deviate to far off outside the band which they called overbought/oversold situation. See the picture below.

Japanese Candlestick

Reversal signals from Japanese candlesticks charting can be studied on the chart patterns formation as discussed earlier post "Candlestick continuation & Reversal Signals". Example of reversal formations are the morning star, hanging man, evening star, and hammer which are actually very identical to each other. See the picture below.

Relative Strength Index (RSI)

Another reversal indicator we can use is the relative strength index (RSI) to determine the future direction of the market. This indicator is also called a leading indicator because it predicts the future direction of the ahead of real time market movement. Usually traders will used RSI signal by the rule they called 70/30 rule. This means that when the RSI signal line move from 50 up to 70 it will likely make a reversal back to 50 which is the normal movement. Likewise if the RSI signal moves down from 50 to 30 or below it will likely reverse upward back to 50 normal movements.

MACD & Stochastic Combination

As discussed earlier a strong movement of the market will only proceed successfully when both MACD and slow stochastic move in parallel direction. Read here…

In summary using these indicators individually without solid integration from other indicators' signal can only bring temporary success. The ability to integrate them together in the manner that it will give the best signal is far more important to success. And also in-depth understand of multiple time frames will increase the precision to your trading decisions.

Tuesday, April 8, 2008

Multiple Time Frames Systematic Analysis

I am going to use 3 of the following indicators

- Bollinger Bands – To determine support and resistance level

- Slow Stochastic – To determine the short-term movement

- MACD – To determine the overall movement

Put them in a table. I am going to use GBP-JPY to make the explanation specific.

The initial setup will start from the top of the Bollinger bands for monthly time frame and our expected target is at the bottom of the Bollinger bands. Assume that the first move all stochastic and MACD in all time frames moving downward.

According to the natural movement that it must move and past through support and resistance level before any movement reaching its target. These are obstacles we have to consider so that we can utilize the situations to our favor.

The monthly time frame is a long time to wait especially when it comes to support and resistance level it will take months to break before moving to the next level and continue to the targets. Based on the GBP-JPY chart it takes approximately nearly a month or more to successfully battling each of the obstacles along the way.

Now the question is how do we determine the support and resistance level? The key is the weekly time frame which is the closest to monthly time frame. Therefore the strongest support and resistance area will be created when the weekly stochastic is moving upwards. The rest of the minor time frame 1H, 4H, Daily will be easily broken because they cannot stand the long-term traders power. These minors time frame will be active again to create volatile price movements at the support and resistance level.

Upon reaching the strongest resistance level weekly stochastic will move upwards heading toward the middle Bollinger bands. It will sometimes reach the middle but most often not exactly. However on the daily time frame target will be exactly in the middle or a little bit more because both daily MACD and Stochastic are moving parallel upwards. Upon reaching the highest point, this will create the limit peak for fluctuation for the support. Based years of observations i've come to note that the market will generally fluctuate to create 3 peaks in sideway direction before breaking the resistance level to continue the trend downward. As you can see on the chart below.

Keep in mind that the overall trend is still going down as MACD and stochastic monthly time frame is still go downwards direction. This is to reduce the amount of doubts to think the trend might reverse upside suddenly. Don't be afraid of the reversal because every trader including those with the most money also fears that they will lose money if they go against the market direction.

The next setup will be located in the middle and as the slow stochastic moving downwards it is definitely going to move down to the bottom of the weekly time frame trying to break the resistance level. When it is broken the trend will move down until it reaches the next resistance level when the weekly stochastic start to move up again. At resistance level fluctuation start to occur again before make any continuation.

This process will go on and on until it reaches the monthly bottom Bollinger bands. After that then the market will retrace to the middle of the monthly time frame. If you want to be good in this you need to practice to look at the market behavior based on these three indicators you will be improving better in your trading. This system is based on the mathematics of moving average, where it round up the best average from all trading activities.

If you have any confusion or in-depth questions about this system leave me your thoughts on the comment i will try to help as much as i can.

Saturday, April 5, 2008

MACD and Slow Stochastic Combination

MACD or Moving Average Convergence/Divergence is a lagging indicator that still very much in used today by traders. Despite of its lagging effect the application is solid when it is moving on its way. For example when it moves upwards it will not easily stop until it is reaching the point of interception. And further more to twist direction it will at least take sometimes generally two cycles of the stochastic. This solid movement provides the traders the hint of the overall direction of the market movement.

Even though slow stochastic is the most recent movement of the chart but it requires a solid foundation to support its movement. Without the solid foundation stochastic usually make temporary short-term fluctuation without clear direction. Therefore by using a lagging indicator like MACD the movement of slow stochastic can be assured and solid.

Let's take a look how these two indicators can work hand in hand to show a clear direction of movement. See the chart below.

Notice on the chart above when stochastic is moving along on the foundation of MACD it will keep moving up. Because of stochastic is moving faster than MACD it will make the first downturn but only for temporary and later move up again follow the MACD. Until then when MACD is making a twist downwards direction, following by stochastic the movement will be strong.

In this example we can see that Stochastic is unable to move long enough perfectly without the foundation of MACD. It will only cause short-term correction. Until MACD is moving parallel with stochastic then it will be perfect movement. This combination of technical indicators is best use on 4 hourly and daily time frames to increase its accuracy.

Bollinger Bands and Slow Stochastic Combination

As discuss in the earlier blog, Bollinger bands is used to measure the level of support and resistance where the market usually fluctuates. In other words the market will move ups and downs inside the area of the Bollinger bands. However in reality as you may notice on your trading chart, the market moves not necessarily exact within the bands area (support & resistance level). This is cause by the effect of emotions involves in everyday trading which resulting the market to create overbought and oversold patterns that goes beyond the Bollinger bands area. See picture below.

The interesting part of overbought/oversold position is because it is emotional therefore the effect is very short. And the chances of the market movement to make a correction back to its normal position are very high. Despite of this in most cases inexperience traders would execute their trading ahead of the overbought/oversold positions which can create emotional doubts that they are making the wrong decision. Further more they are loosing some precious pips from the short-term movement.

Now the point is how can you improve you trading decisions by reducing the amount of such errors and utilize the situation to harvest precious pips. One of the ways experience traders usually do is by adding another indicator called Slow Stochastic. As discussed earlier the slow stochastic advantage is the movement is the most recent along with the market movement. Therefore the fluctuations of the market generally move according to the slow stochastic fluctuations.

By using the two indicators we can have better signals of twists and turns of the market. As the market generally move inside the area of the Bollinger bands as but it is also frequently move beyond the bands area. In order to reduce the possibility of error not to make decision ahead of the market we use the slow stochastic signals using the following strategies.

- Do not open position on the top or bottom of the Bollinger bands before stochastic has not signals any reversal.

- Open a position when the candlestick goes beyond the band area and at the point of intersection of the slow stochastic.

- These two combinations can be improved better accuracy by adding MACD indicator.

However yet again I have to remind you the best use of these indicators will be better if you have in-depth understanding of it on multiple time frames application.

Popular Posts

-

Trade result for EUR-USD and AUD-USD on the 4th June 2016 As expected the EUR-USD and AUD-USD should go for major correction after an ex...

-

Let's take a look at the historical chart of the major currencies traded in Forex over the course of 37 years period since 1978 until pr...

-

Strong bearish signal has pushed the EUR-USD deep to oversold position, but is it going to stop soon when the Euro Zone market open or conti...

-

MACD Settings:- First EMA = 12 | Second EMA = 26 | Signal EMA = 9 Stochastic Settings:- Period = 5 | Average Period Fast = 7 | Average Pe...

-

MACD Settings:- First EMA = 12 | Second EMA = 26 | Signal EMA = 9 Stochastic Settings:- Period = 5 | Average Period Fast = 7 | Average Pe...

-

MACD Settings:- First EMA = 12 | Second EMA = 26 | Signal EMA = 9 Stochastic Settings:- Period = 5 | Average Period Fast = 7 | Average Pe...

-

The movement is now totally out of hand. Volatility is unpredictable and yet it is vigorously moving up and down between support and resista...

-

EUR-USD trading last Friday 19 Feb 2016. There is a strong sentiment the EUR-USD might be heading for major correction upside as the MACD an...

-

MACD Settings:- First EMA = 12 | Second EMA = 26 | Signal EMA = 9 Stochastic Settings:- Period = 5 | Average Period Fast = 7 | Average Perio...

-

MACD Settings:- First EMA = 12 | Second EMA = 26 | Signal EMA = 9 Stochastic Settings:- Period = 5 | Average Period Fast = 7 | Average Pe...