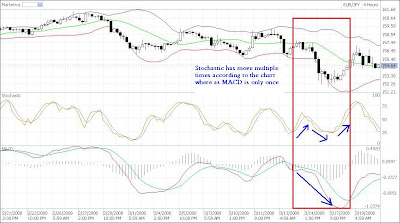

Despite of the exact application of the two, slow stochastic has a major advantage over MACD. It's speed of movement faster than MACD and it moves closely following the real live chart movement. Therefore it is heavily used by daily traders to take advantage of the short-term volatility movement of the chart. See the chart below as MACD moving downwards once but stochastic has already take two cycle to downwards direction. This major advantage making slow stochastic as the most popular indicator of all.

Despite of the exact application of the two, slow stochastic has a major advantage over MACD. It's speed of movement faster than MACD and it moves closely following the real live chart movement. Therefore it is heavily used by daily traders to take advantage of the short-term volatility movement of the chart. See the chart below as MACD moving downwards once but stochastic has already take two cycle to downwards direction. This major advantage making slow stochastic as the most popular indicator of all. Slow stochastic is almost universal usage, and every traders who have known about its application will use it. The most effective application of this indicator is by combining with other indicators and also the in depth understanding of multiple time frame

Slow stochastic is almost universal usage, and every traders who have known about its application will use it. The most effective application of this indicator is by combining with other indicators and also the in depth understanding of multiple time frameMarketiva Forex: Trade as low as $1 & FREE $5 + $10000 Virtual Practice Money

No comments:

Post a Comment