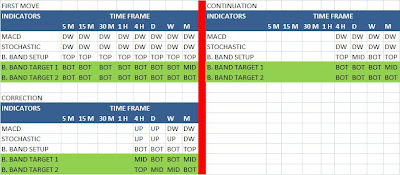

The idea of using multiple time frames is because the currency market is so dynamic and volatile. Each of the volatility occur differently in each of the time frame therefore it is very important analyze each of them.

Waking up everyday before you start trading create this kind of analysis to look at the overall market structure. And of course the first to look at is the highest time frame which is the monthly period. This is to figure out the overall market structure throughout the whole month. After that move down into small time frame to look into details and any particular opportunities that arise during that day.

Hopefully this method will provide you the basic foundation how you can develop your own technical analysis system on daily basis to help you make better decision in forex trading. Happy trading!!!

Marketiva Forex: Trade as low as $1 & FREE $5 + $10000 Virtual Practice Money

No comments:

Post a Comment